In our last State of the Market for Nonprofit Insurance report in 2020, brokers accurately predicted a prolonged hardening of the property and casualty market, with nonprofits being some of the hardest hit.

Since the beginning of 2020, NIA has served as the safety net for nonprofits, as commercial carriers have abandoned them. In particular, large nonprofits that were used to carriers competing for their business have been surprised that they got nonrenewals, too.

NIA has seen dramatic and unprecedented growth in this time, going from insuring 20,000 nonprofits to nearly 27,000, and our gross written premium has more than doubled — from $154.3 million to $314.7 million.

A lot has changed in the market and the world since the last survey. We thought it would be a good time to check in with brokers on some of the same questions.

Spoiler alert: While some insurance publications are predicting easier markets ahead, brokers don’t seem to share their optimism about the nonprofit market.

Difficulty Finding Coverage and Limits

In every class of nonprofit business except for one (trade associations), more brokers responded that they are finding it difficult to find adequate coverage and limits versus those that said they were not finding it difficult.

Topping the list as the most difficult to find? 70.5% of brokers reported that it was difficult to find commercial insurance companies willing to insure foster family agencies (FFAs), including kinship care. (FFAs also topped our 2020 survey as the most difficult to find coverage for, with 78% of brokers reporting difficulty.)

After FFAs, brokers reported the most difficulty in finding adequate coverage and limits for affordable housing (69%); low-income housing (60%); homeless shelters (58%); residential treatment centers (56%); child-serving organizations (49%); camps (47%); daycare centers (47%); animal rescues (45%); civil justice organizations (42%); Boys & Girls Clubs (29%); environmental protection (28%); fiscal sponsors (20%); and charter schools (18%).

In the results below, “Neutral” was also the default answer for many brokers for whom the class was not applicable to them, or they had no opinion about it.

Please don’t take high neutral responses as an indicator of market stability. You can sort this data by clicking any of the table headers below.

| Class of Nonprofit | Difficult | Neutral | Not Difficult |

|---|---|---|---|

| Affordable Housing | 69% | 29% | 2% |

| Animal Rescues | 45% | 48% | 6.5% |

| Boys & Girls Clubs | 29% | 56% | 15% |

| Camps | 47% | 44% | 9% |

| Charter Schools | 18% | 65.5% | 16.5% |

| Child-serving Organizations | 49% | 39% | 12% |

| Civil Justice Organizations | 42% | 52.5% | 5.5% |

| Daycare Centers | 47% | 41.5% | 11.5% |

| Environmental Protection | 28% | 60% | 12% |

| Fiscal Sponsors | 20% | 69% | 11% |

| Foster Family Agencies (including Kinship Care) | 70.5% | 26.5% | 3% |

| Homeless Shelters | 58% | 36% | 6% |

| Homeowners Associations | 29.5% | 46.5% | 23.5% |

| Residential Treatment Centers | 56% | 37% | 7% |

| Trade Associations | 13% | 61% | 25.5% |

Select Broker Comments:

“As the market continues to harden in the nonprofit space, not only are certain classes becoming harder to place, but limits and exclusions on coverage have become prevalent and make it harder to appropriately cover our clients’ exposures.”

“Mostly due to acute distress in the property insurance market, all property coverages are difficult to get.”

“Very few insurers are offering coverage for animal rescues anymore. Pretty much no one other than NIAC wants to write an organization that fiscally sponsors projects.”

“Nonprofits working with the youth, elderly, animals, and residential exposures are challenging. Abuse, higher limits, and affordability are challenges across most nonprofits.”

“The number-one increasingly difficult placement issue I experience is with religious organizations and churches.”

“Foster family agencies and homeless shelters are two of the most difficult coverages to place. NIAC has been more willing and able to provide coverage for these difficult classes of business over other carriers in the marketplace.”

“Any part of the nonprofit child services sector has become increasingly difficult to find coverage for. Property coverage for nonprofits is also very difficult to find.”

“The state and federal contract guidelines are such that you’re not able to obtain the levels of coverage required from non-ANI/NIA carriers.”

70% of Brokers Say Commercial Carriers are Nonrenewing Nonprofits Across the Board

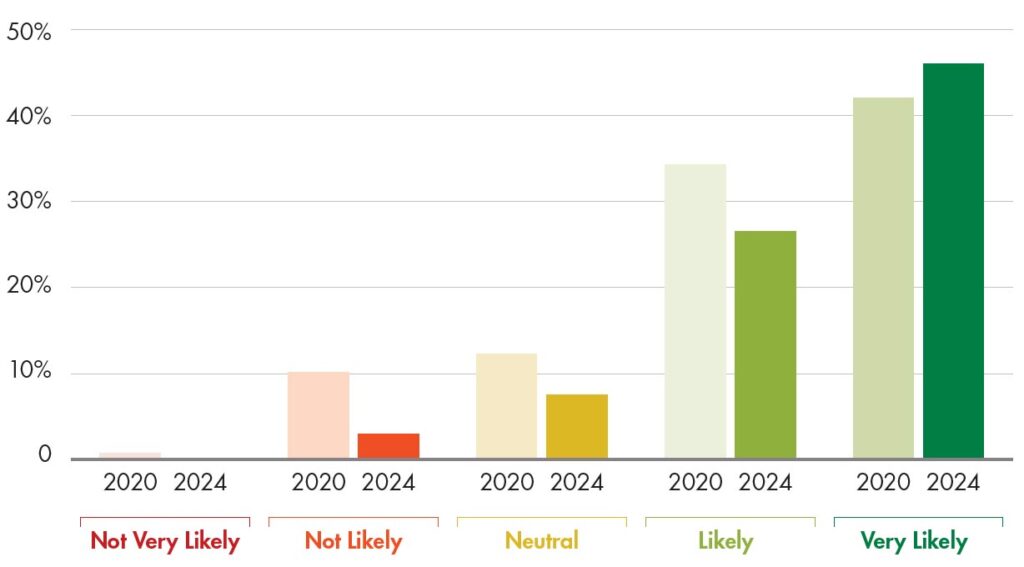

70.5% of brokers say carriers are nonrenewing certain classes for businesses without regard to loss history. This is up 14.5% from what was reported in 2020 (56%).

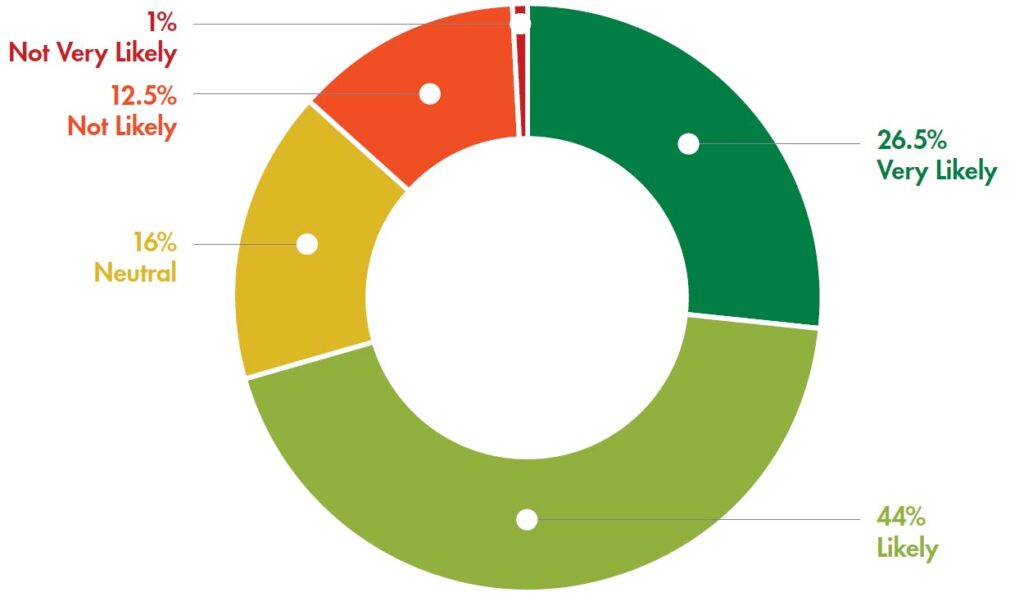

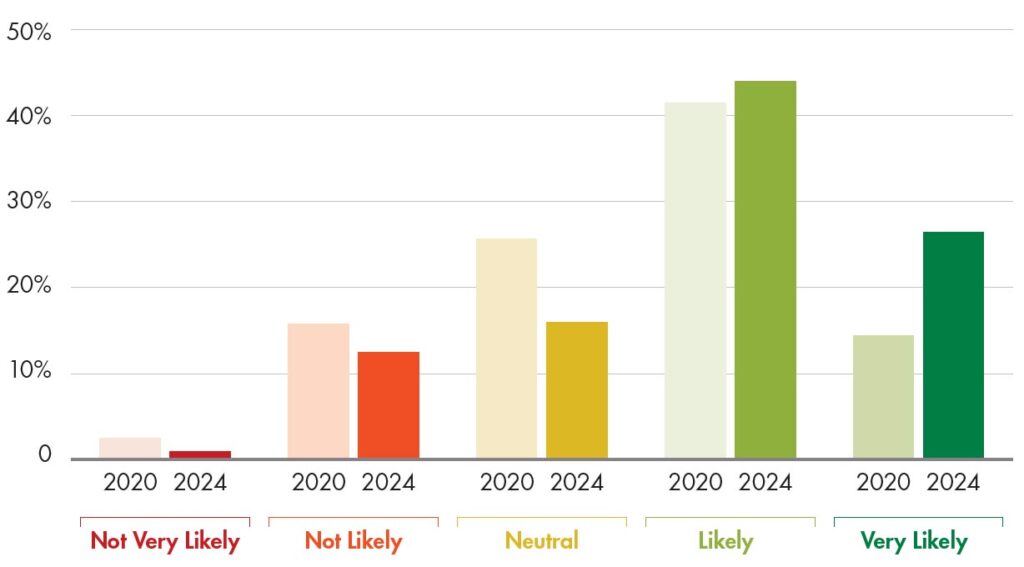

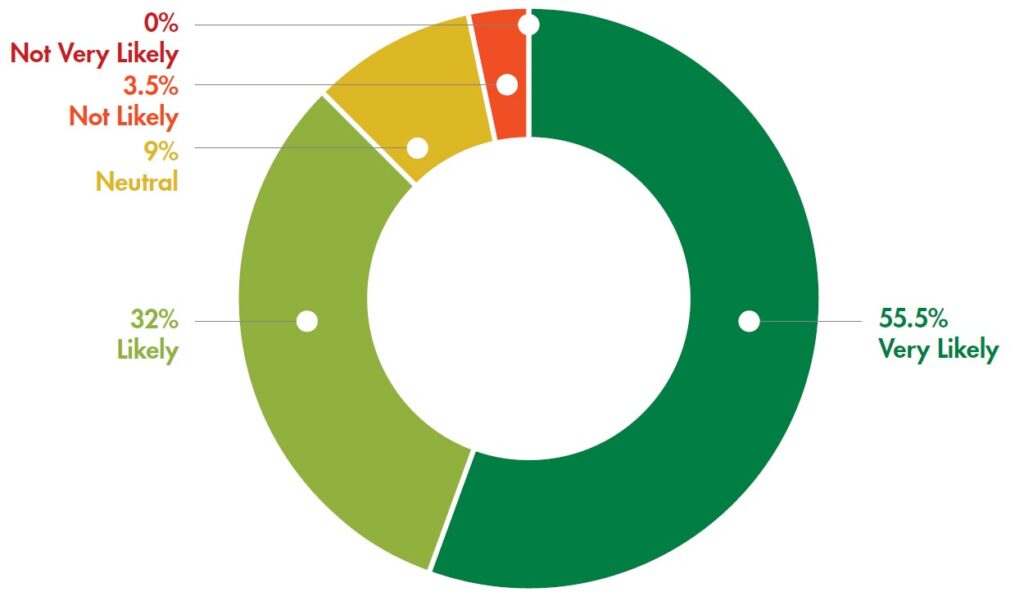

In your experience, how likely is it that some commercial carriers are nonrenewing certain classes of nonprofits, across the board, without regard to loss history?

2020/2024 Data Comparison:

Select Broker Comments:

“Most commercial carriers do not understand the nonprofit market and have for years been simply chasing premium without learning what services are actually performed by the nonprofit(s). Now these carriers are leaving the market as quickly as they originally came in.”

“The carriers that are remaining are reducing the limits they offer and raising their prices.”

80% of Brokers Say Nonprofits are Seeing Premium Increases of 25% or More

79% of brokers are seeing increases of 25% more for their nonprofit clients. This is up 17% from what was reported in 2020 (62%).

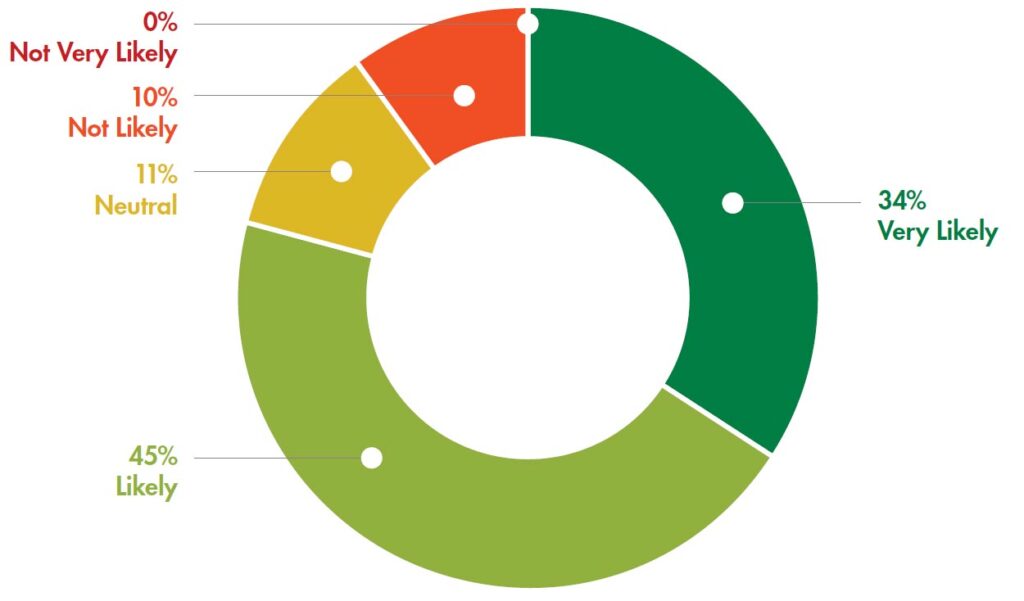

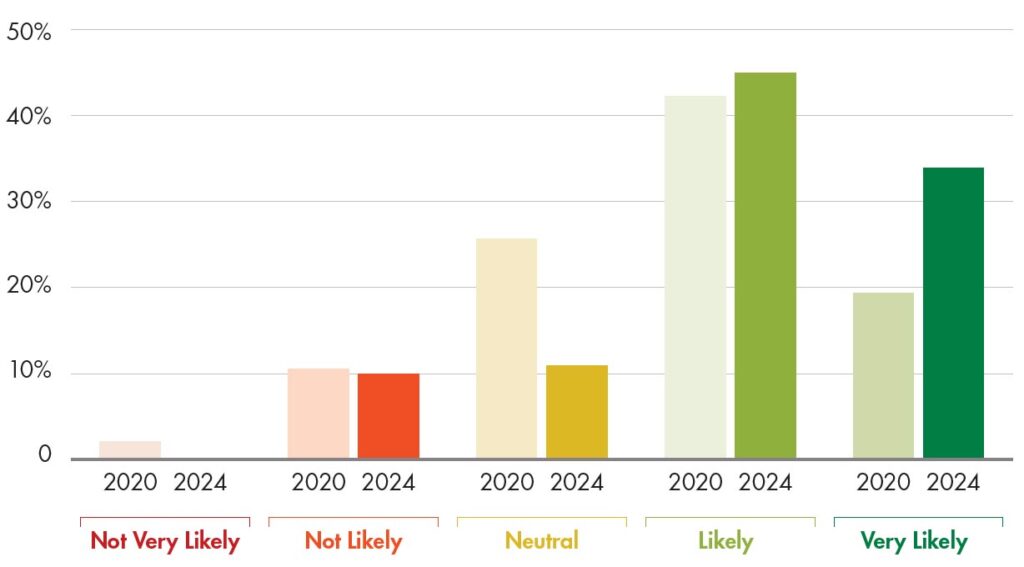

In your experience, how likely is it that some commercial carriers are raising prices by 25% or more on certain classes of nonprofit organizations?

2020/2024 Data Comparison:

Select Broker Comments:

“Providing quality and affordable coverage to nonprofits is extremely difficult and upsetting when you know quality organizations are directing their limited funds away from the programs meant to help people and into the pockets of insurance companies. Every increase in premium is a dollar out of the budget.”

“Increases in premiums over 25% aren’t uncommon.”

“Our issues are primarily associated with the property line. Large rate increases, large wind/hail deductibles, and ACV terms are becoming more common.”

Nearly 90% of Brokers Say Commercial Carriers are Restricting Coverage for Child-Serving and Social Service Nonprofits

87.5% of of brokers say commercial carriers are restricting coverage and limits for improper sexual conduct insurance for nonprofits that serve children. This is up 10.5% from what was reported in 2020 (77%).

In your experience, how likely is it that standard commercial carriers are restricting coverage and limits for sexual abuse (improper sexual conduct) for child-serving and social service nonprofits?

2020/2024 Data Comparison:

Select Broker Comments:

“It is becoming impossible to find quality and affordable abuse coverage for nonprofits who keep our communities running. A lot of people would have nothing without these nonprofits.”

“This is causing the most pain as these nonprofits have contractual obligations to meet and excess coverage is astronomical to get from a premium standpoint, not to mention for a nonprofit organization.”

“Other than in the nonprofit market, it’s not possible to have abuse and molestation included under a policy.”

“It is very difficult to place business that has claims-made professional liability and abuse.”

Conclusion

One broker summed it up very well:

“NIA is a great market that is pure to their mission. The other carriers’ major concern is their stock price: They are either jealous, feel threatened, or are just plain greedy.”

We thank all the brokers that took the time to respond to this survey, and for their many thoughtful and kind comments.

If your nonprofit is not a member of Nonprofits Insurance Alliance and you’d like to learn more about joining our community, please check out our list of coverages, as well as the benefits of membership.