Clear signs of the property and casualty market heading into trouble started showing in 2019. Nonprofit policyholders would be “treading water,” Insurance Journal reported. The Wall Street Journal reported in February that one nonprofit saw their renewal quote increase from $76,000 to $750,000.

For some insurers, this is a time to usher in better shareholder returns. As one executive noted, “This hardening is much higher than anything we’ve seen over the last probably 15-20 years.”

So just how bad is it for policyholders? Our 2020 State of the Market Survey polled brokers across the U.S in August. Nearly 300 agents responded.

Difficulty Finding Coverage and Limits

In every class of nonprofit business in the survey apart from four, more brokers responded that they are finding it difficult to find adequate coverage and limits versus those that said they were not finding it difficult. Notably, 78% of brokers reported that it was difficult to find commercial insurance companies willing to insure foster family agencies, including kinship care.

Brokers reported difficulty finding adequate coverage and limits for animal rescues (64% of brokers responding); camps (50%); child-serving organizations (55%); civil justice organizations (55%); daycare centers (40%); environmental protection (39%); fiscal sponsors (39%); homeless shelters (66%); low income housing (60%); and residential treatment centers (60%).

| Class of Nonprofit | Difficult | Neutral | Not Difficult |

|---|---|---|---|

| Animal Rescues | 64% | 16.4% | 20% |

| Boys & Girls Clubs | 34% | 29.2% | 37% |

| Camps | 50% | 20.3% | 30% |

| Charter Schools | 30% | 30.1% | 40% |

| Child-serving Organizations | 55% | 19.2% | 26% |

| Civil Justice Organizations | 55% | 29.5% | 15% |

| Daycare Centers | 40% | 22.6% | 38% |

| Environmental Protection | 39% | 35.5% | 26% |

| Fiscal Sponsors | 39% | 40.9% | 20% |

| Foster Family Agencies (including Kinship Care) | 78% | 15.5% | 6% |

| Homeless Shelters | 66% | 20.8% | 14% |

| Homeowners Associations | 18% | 28.6% | 53% |

| Low Income Housing | 60% | 25.8% | 14% |

| Residential Treatment Centers | 60% | 22.3% | 18% |

| Trade Associations | 21% | 29.3% | 50% |

Some Commercial Carriers are Nonrenewing Nonprofits Across the Board

Nearly 56% of brokers say carriers are nonrenewing certain classes for businesses without regard to loss history. “Smaller nonprofits are harder to place, as premium threshold is raised to $27,000 to even submit an account for quoting,” says one broker.

Another indicates, “The market is changing daily.”

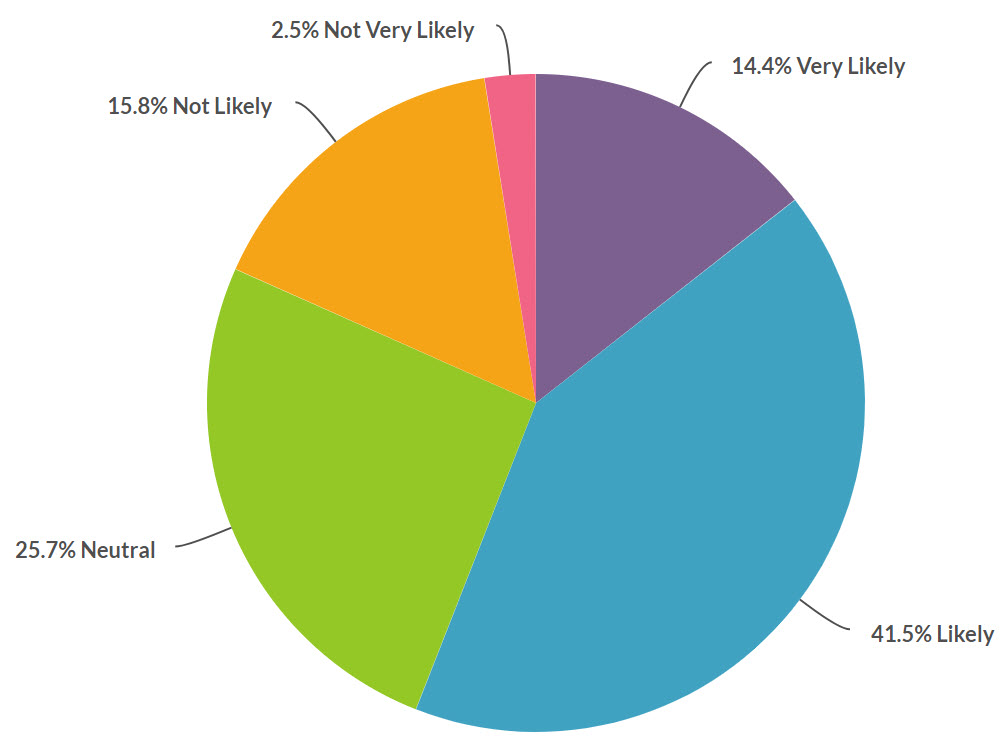

In your experience, how likely is it that some commercial carriers are nonrenewing certain classes of nonprofits, across the board, without regard to loss history?

Yet another broker says, “In the current environment, policies are much stricter with additional exclusions, and premiums are rising exponentially without regard to loss history and/or class of business.”

Nonprofits are Seeing Premium Increases of 25% or More

Nearly 62% of brokers are seeing increases of 25% more for their nonprofit clients.

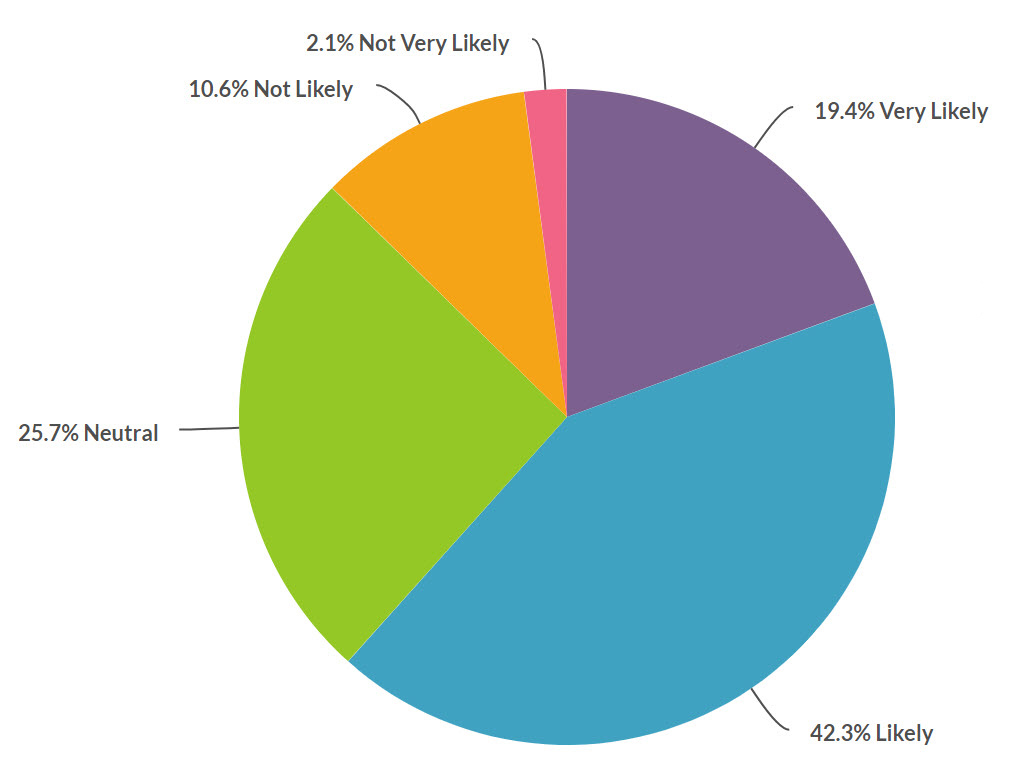

In your experience, how likely is it that some commercial carriers are raising prices by 25% or more on certain classes of nonprofit organizations?

Nonprofits work under very tight budgets in the best of times. Now, nonprofit finances are being stretched as organizations are asked to continue to provide services with additional expenses due to the pandemic.

Double-digit premium increases will likely force nonprofits to cut services. “Many are hurting,” says one broker. “Their revenue has plummeted, fleets are not in use, and then we deliver worse terms for more money.”

Commercial Carriers are Restricting Coverage for Child-Serving and Social Service Nonprofits

Nearly 77% of brokers say commercial carriers are restricting coverage and limits for improper sexual conduct insurance for nonprofits that serve children. “Exposure to children, developmentally disabled persons, or income disadvantaged persons create the largest concerns for standard carriers,” says one broker.

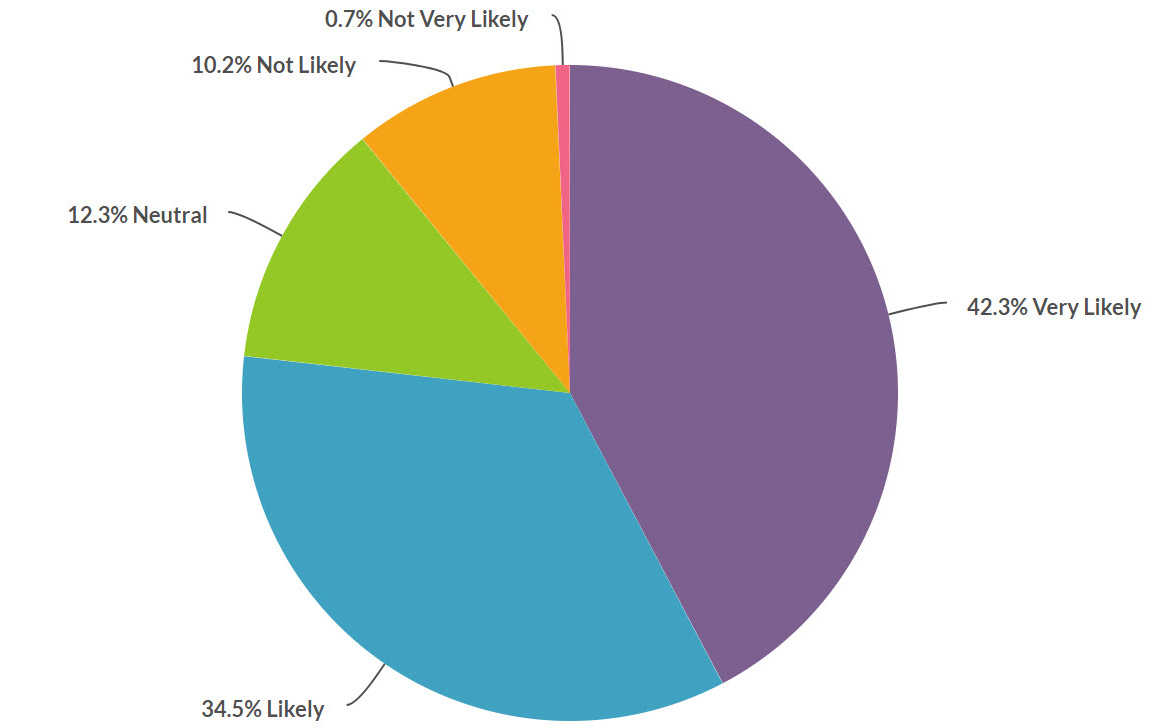

In your experience, how likely is it that standard commercial carriers are restricting coverage and limits for sexual abuse (improper sexual conduct) for child-serving and social service nonprofits?

“I have noticed limitations or lower limits on sexual misconduct and lowering limit on umbrella coverages with higher pricing,” says another.

Yet another says, “Providers of youth services are being hit the hardest; however, all of my social services were bracing for impact this year due to rate increases, more restrictive coverage language, and reduced limits.”

Several brokers reported having few markets to approach for nonprofits, and many expressed appreciation for having a go-to insurer for nonprofits, especially in this climate. “I love working with Nonprofits Insurance Alliance!” announced one broker. Another said, “We appreciate NIA in all aspects. The underwriters are helpful, service is excellent, and NIA offers robust coverage for our clients.

If your nonprofit is not a member of Nonprofits Insurance Alliance and you’d like to learn more about joining our community, please check out our list of coverages, as well as the benefits of membership.