On Wednesday, August 21, 2024, Nonprofits Insurance Alliance of California (NIAC) announced it will be sending out notices of nonrenewal for all coverages for all FFAs in the state of California, after it was made clear to us that AB 2496, The Foster Family Agency Protection Act, is unlikely to pass in a form that allows FFAs to be insurable. (Note: NIAC may amend this position based on the final outcome of the bill.)

Today, we want to color in some details on how we got to where we are now. We owe this transparency to everyone who fought for the 9,000 children in FFA resource homes, and for the survival of California FFAs.

Before we say more, there are a few parties that need to be recognized and thanked for being on the side of the children from the very beginning.

First, we want to acknowledge the dedicated and hardworking people that comprise California’s foster family agencies. They do incredibly important work under extremely difficult circumstances, and it is not their fault that we find ourselves in this situation.

Additionally, Assemblymember Gail Pellerin and her chief of staff, Ashley Labar, have been unrelenting in their advocacy for the children. They deserve the gratitude of all Californians.

FFAs are a convenient scapegoat

When we first sponsored AB 2496, we naively believed that if the legislature understood the root of the problem, they would understand that AB 2496 is a modest and reasonable cure for this dysfunction in our judicial system.

However, after meeting with the offices of key politicians that have the power to enact a useful version of AB 2496, we are now convinced it’s not that they don’t understand the problems, it’s that they just want a scapegoat.

To explain what this means, we must start at the very beginning.

- When children are in danger, California counties take custody of the children.

- The counties then place some of these children in foster homes (also known as “resource homes”) that are certified and overseen by foster family agencies.

- For the safety and well-being of these children, the state requires that the foster family agencies follow certain due diligence before certifying a home and during the process of overseeing the foster child in the home.

- In most cases, these placements happen without any issue whatsoever.

- However, when a child in a foster home is harmed, and the foster family agency could not have foreseen the harm, the foster family agency can still be found at fault and required to pay tens of millions of dollars.

- Because a child was harmed, the expectation is “someone ought to pay,” and FFAs are being held responsible even if they did nothing wrong. This is what we mean when we say that foster family agencies are being set up as scapegoats.

Now let’s take a few more steps, to show how insurance factors into this:

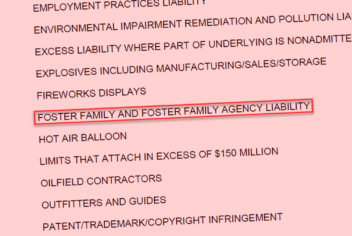

- The counties require that foster family agencies carry insurance. But, because foster family agencies are being held accountable for the wrongful acts of others beyond their scope of control, it makes foster family agencies “uninsurable.” This is why every major commercial insurer of foster family agencies in California has already nonrenewed them, and abandoned the California foster family agency insurance market entirely. The lone holdout, NIAC, is a nonprofit risk pool with the mission of providing coverage for other California nonprofits. NIAC currently covers 90% of California foster family agencies.

- Rather than immediately nonrenew coverage of all foster family agencies, NIAC chose instead to try to help stop the systemic scapegoating of California FFAs by sponsoring AB 2496, The Foster Family Agency Accountability Act.

- After many months and a lot of money spent advocating for AB 2496, NIAC made the decision that there is not the political will to allow foster family agencies to be insurable by making modest changes to existing law.

Child abuse is morally indefensible. What has broken this system is holding innocent FFAs responsible for the abuse caused by other parties, when they had no way of anticipating it or preventing it. And that’s exactly what the primary opposition to AB 2496 has been defending.

Meet the main opposition to AB 2496

From the beginning, the main opposition to AB 2496 has been a group called the Consumer Attorneys of California (CAOC). Early in the process, we heard that nothing moves through California legislature’s Judiciary Committees without their approval.

Still, we optimistically believed that the fate of 9,000 foster children would be enough to get politicians to act in good faith to correct the problems once the flaws in the system itself were made clear. We were wrong.

The top 20 plaintiff firms donated $15.5 million to California politicians, and 43% of that — more than $6.7 million — were made to committees affiliated with CAOC. They are a powerful group of plaintiff attorneys who claim to be protecting children while getting huge paydays for themselves. It appears to us that Judiciary Committees have been in an echo chamber with the plaintiff attorney members of CAOC and are not open to counterarguments. They are certainly not listening to advocates for foster children or the hardworking people of the nonprofit sector.

Some in power, even when they know this is a problem and have no other solution to offer, appear to be willing to see the foster family system collapse before offending their plaintiff attorney friends or risk cutting into those attorneys’ earnings. Such is the power of the dollar.

So, what happens now?

Since we announced our nonrenewal of California FFAs last week, there’s been a flurry of activity:

On August 23, California Insurance Commissioner Ricardo Lara issued a notice that acknowledges of the lack of insurance available for California FFAs. In the notice, he asks property and casualty insurers to consider covering FFAs again, and he requests that insurers tell him what they “believe” the barriers for entry are into this market.

However, Commissioner Lara already knows the answer. Indeed, earlier in the same notice he accurately describes the exact reason why commercial insurers abandoned the FFA market in the first place.

There are four specific problems in the judicial system that prevent carriers from re-entering the FFA market:

- FFAs are held responsible for the unforeseeable criminal acts of others

- FFAs that substantially meet their responsibilities under state licensing laws are often held accountable to a different standard by the courts

- FFAs are held responsible for the negligence of counties

- Plaintiff attorneys are making huge, time-limited, monetary demands against FFAs and the insurers that protect them, before sufficient facts are available to evaluate these claims

The solutions to each of these problems are the original language of AB 2496. Since the Insurance Commissioner has no power to fix capacity problems caused by the judicial system, it’s unclear exactly what, if anything, Commissioner Lara can do to help California FFAs — other than announce he’s aware of the problem.

The language in AB 2496 has been greatly amended. Our reading of it is that the state’s plan is to direct the counties to take over certification and oversight of resource homes from the FFAs. There is a wrinkle: These children need a lot of services and oversight, and we understand that the counties may not have the staff to do that. FFAs could provide those services to the counties, but the counties’ insurance programs don’t want to take on the risk. We could have predicted that one.

This crisis could have been easily averted — at no cost to government or disruption to the FFA system — and it continues unfolding in California. Those with money and power have once again protected themselves at the expense of those less fortunate.