RRGs explained.

The alternative risk transfer market includes options such as self-insurance, risk pools, captive insurance, and risk retention groups (RRGs).

RRGs were formed by an act of Congress and have been around for decades. This brochure will help you understand RRGs in general and give you an overview of Alliance of Nonprofits for Insurance, RRG (ANI), a part of the Nonprofits Insurance Alliance (NIA) group brand.

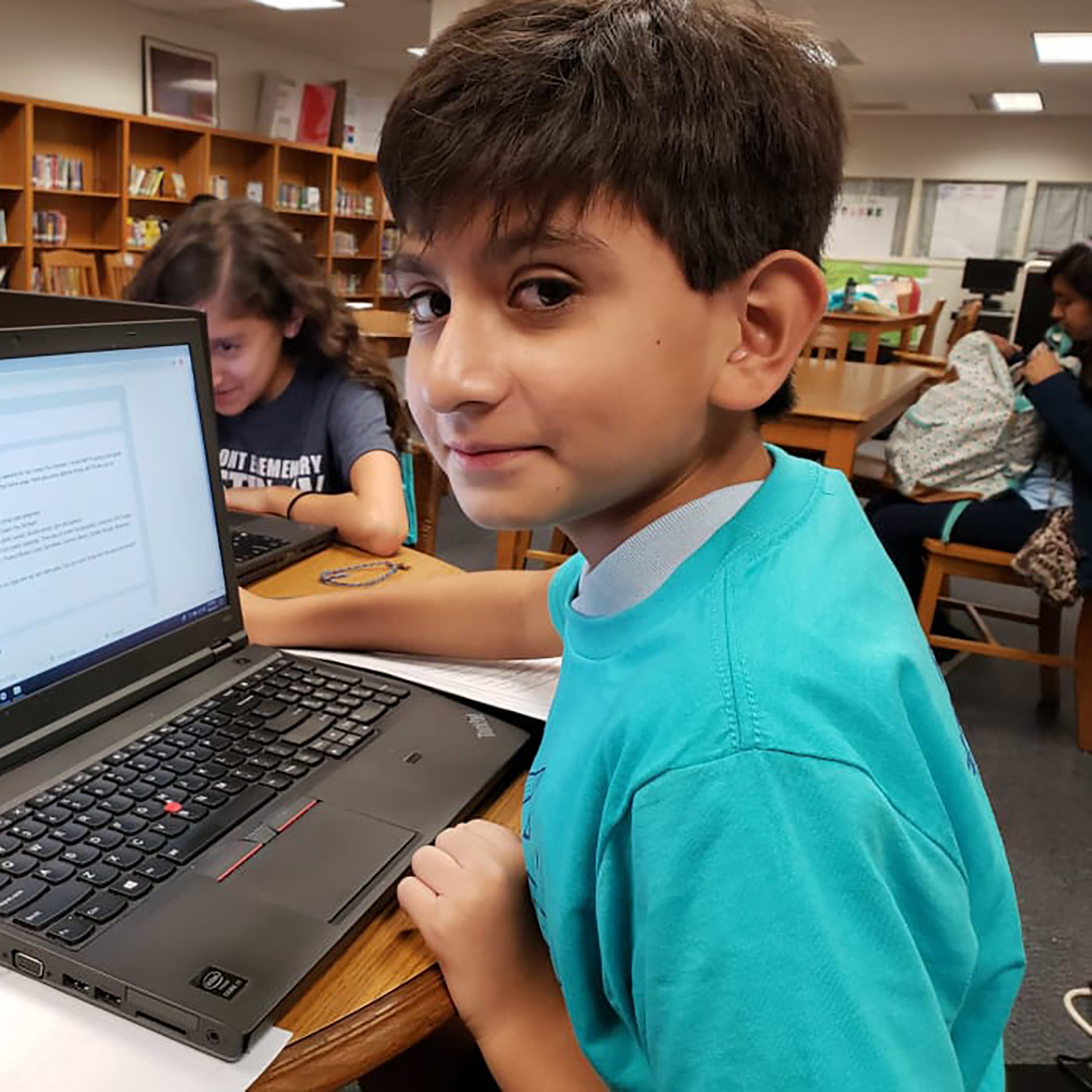

Insured by NIA:

Bold Idea

Dallas, TX

What is a risk retention group?

A risk retention group (RRG) is a liability insurance company that is owned by its members. RRGs must be a licensed insurer in one state.

Once licensed, an RRG can insure members in all states where it’s registered to do business. As insurance companies, RRGs typically retain a portion of the risk they underwrite.

Who forms risk retention groups?

Risk retention groups are often formed from and sponsored by trade and professional associations. RRGs can only include those engaging in a similar business or activities and having similar liability risk exposure. Alliance Member Services (AMS) formed nonprofits’ own RRG in 1999, exclusively for 501(c)(3) nonprofit organizations.

What is ANI?

Alliance of Nonprofits for Insurance (ANI) is nonprofits’ own RRG. It is part of the NIA group brand and is an insurance company domiciled in Vermont. ANI writes liability insurance for 501(c)(3) nonprofits in 31 states and D.C. ANI is a 501(c)(3) nonprofit organization, just like the nonprofits we insure.

ANI’s mission is to serve 501(c)(3) nonprofits by providing a stable source of fair and equitably priced liability insurance coverage tailored to the specialized needs of the nonprofit sector. We also work to assist these organizations to develop and implement successful risk management programs.

ANI’s audited financial statements are available for review. They reflect our excellent financial solvency and strength. ANI is rated A- (Excellent) by AM Best. AM Best is the insurance industry’s primary financial rating agency.

What are the advantages of risk retention groups?

RRGs are owned by their members, so key advantages relate to control members obtain over their liability programs. This control often results in lower rates over the long term, broader coverage, and stable rates. ANI’s Board of Directors is elected annually by its member-insureds.

RRGs typically offer effective loss control/risk management programs leading to favorable loss experience for members and the group overall. ANI provides specialized coverages, claims service, and loss control and risk management resources focused only on the nonprofit sector.

What kinds of insurance coverage do risk retention groups provide?

The type of insurance coverage RRGs are permitted to offer is set forth in the federal Liability Risk Retention Act (LRRA)’s definition of “liability.” This includes all types of third-party liability, such as general liability, errors and omissions, directors and officers, professional liability, commercial auto liability, and so forth.

The LRRA today does not extend to workers’ compensation, property insurance, or to personal lines insurance, such as homeowners and personal auto insurance coverage. However, ANI does have a companion program with a property insurance carrier to provide property coverage for its members. Find out more about NIA’s coverages.

Although the Liability Risk Retention Act is a federal law, it relies on the state of domicile insurance department for its implementation. The state in which the RRG is domiciled has regulatory authority over the risk retention group. ANI is regulated by the Department of Financial Regulation in the state of Vermont.

How much premium do risk retention groups generate?

According to surveys conducted by the Risk Retention Reporter, RRGs’ annual premium has increased from $250.2 million in 1988 to an estimated $3.6 billion in 2019 with an average gross premium of $16.8 million. As such, ANI is much larger than the average risk retention group. As of 2019, there were 213 risk retention groups operating in the United States.

Does ANI have protection for large claims?

Yes. Like commercial insurance companies, ANI maintains a conservative surplus ratio and purchases reinsurance to cover large claims. ANI purchases reinsurance for claims in excess of $450,000 (including defense and indemnity). ANI is reinsured by a group of highly rated reinsurers.

Common broker tools.

These are the most common tools for NIA-appointed brokers.

Your questions answered.

Great job on making it this far. Have some final questions? Here are the top questions NIA hears from brokers. There’s more where this came from, too.

Yes! In fact, NIA writes many organizations that are just starting out.

Just confirm you’ve applied for your organization’s 501(c)(3) status by submitting to NIA a copy of your completed application and proof of payment to the IRS.

Note: You will be required to have your 501(c)(3) status within one year of purchasing coverage.

Yes. Nonprofits Insurance Alliance (NIA) is conservatively reinsured by a group of highly rated reinsurers.

Go to the Claims page to report a claim.

There are many different types of nonprofit organizations, but only federally tax-exempt 501(c)(3) nonprofits qualify for membership with Nonprofits Insurance Alliance (NIA).

NIA insures many types of nonprofits. Find out more about NIA’s appetite.

If you’ve got a brand-new nonprofit, or if you’re thinking about starting one and just doing research for your budget, you may be interested in the minimum annual premiums for all the insurance coverage that NIA offers.

Your insurance quote will most likely differ, as your premium will be entirely defined by your nonprofit’s own level of risk.

Note: These minimum numbers are provided for informational purposes only.