‘Honor the life you’ve lived, with dignity.’

Divine Journeys, of San Diego, CA, is a nonprofit devoted to helping individuals and families find the support they need — emotionally, physically, and spiritually — when presented with an end-of-life diagnosis.

“After an end-of-life diagnosis, life as they know it seems to come to an end,” said Arleen Elloway, President & Founder of Divine Journeys.

When that happens, Divine Journeys works with the person and their families to help them connect with therapy, healing, and other activities that will make their remaining time as pleasant, enriching, and comfortable as possible.

“We don’t want people to feel like they are their diagnosis,” Elloway explained. “We will sit with people and their families to understand where they are at this point in time and how we can match them with someone that may be able to help.”

In these scenarios, she said, help can take many different forms, including yoga, reiki, art therapy, trauma-release exercises, pain management, and guided psychedelic therapy with ketamine.

Divine Journeys does not provide these services in-house, rather they partner with vetted, trusted organizations who will work with clients.

The goal, Elloway said, is to help patients relieve “existential stress” that often comes after receiving an end-of-life diagnosis, help them feel less alone, and to “honor the life you’ve lived, with dignity.”

For Elloway, who comes from a long career in nursing, the mission is a personal one.

As a Trauma Nurse Practitioner, Elloway witnessed the vulnerability of patients facing life and death on a daily basis.

At home, her family are carriers of the BRCA-2 gene, which has resulted in the deaths of many close relatives from breast cancer — so death has been a constant presence in both her personal and professional lives.

“I’ve dealt with a lot of death — it’s near and dear to my heart,” she said. “As you’re approaching that, no one is comfortable.”

Those experiences inspired Elloway and her husband Ken to launch Divine Journeys, with a vision to reimagine the dying process as a sacred and meaningful journey — one filled with comfort, connection, and respect.

They built a board of directors, they settled on a mission statement, and, in 2024, Divine Journeys attained 501(c)(3) status.

In late January 2025, Elloway began looking for insurance.

‘I couldn’t get anyone to talk to me or call me back’

Divine Journeys is Elloway’s first time starting a nonprofit, she explained, so when it came time to start looking for insurance providers and brokers, she made a list.

“I had written down everybody I was going to contact,” she said. “I just started emailing and calling. If I got a denial, I thought, I’d move to the next one down the list.”

However, she quickly realized that brokers and insurance providers weren’t exactly falling over themselves to get Divine Journeys’ business.

“Pretty early on, I couldn’t get anyone to talk to me or call me back,” Elloway said. “Brokers just wouldn’t respond.”

Still, she had a mission that was counting on her, so she soldiered on — working the phones and emails, following up with representatives who were typically unresponsive, unhelpful at best, and openly hostile at worst.

“One woman literally yelled at me and told me to stop calling,” Elloway said. “‘You’re talking psychedelics, you’re talking ketamine, you’re talking end-of-life — those things don’t go together. Do you get it now?’”

“They told me, ‘You need to get rid of everything on your website that has anything to do with ketamine, psychedelics, and end-of-life — then we can talk.’”

Trying to heed the broker’s advice, Elloway and her board proceeded to revamp Divine Journeys’ website and mission statement, removing all references to psychedelics and ketamine.

When they looked at the all the revisions, she remembered thinking “now nobody will even know what we do.”

Nine months went by, and Divine Journeys was still not insured or able to open its doors.

In the meantime, Elloway still had her day job as a nurse practitioner. In that capacity, she signed up as a network provider for Thank You Life, a nonprofit organization with a mission to eliminate the financial barriers to psychedelic-assisted therapy.

Suddenly, she had an epiphany — Thank You Life was a nonprofit whose website mentioned psychedelic therapy and ketamine just like Divine Journeys’ did — and somehow, they had gotten insurance.

“That’s what they do, how did they get insured?” Elloway recalled wondering.

So, she asked Thank You Life who they’d worked with to get insurance — and that’s how she was introduced to Paul Waters, an insurance broker with the NFP brokerage whose specialty is connecting nonprofits to coverage.

‘It was a real jackpot for me to find someone who listened.’

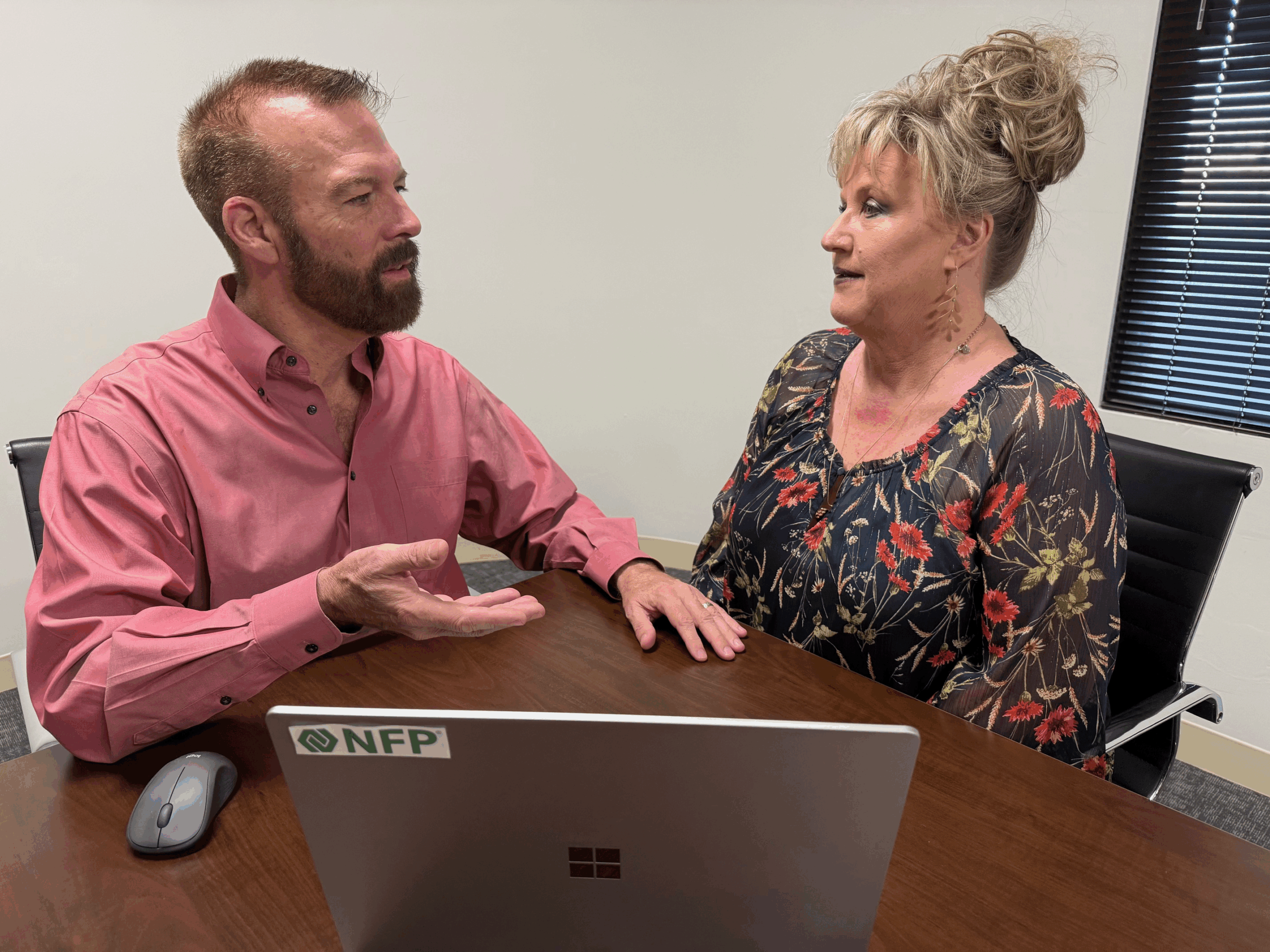

From her first meeting with Waters, Elloway said, she could tell it would be a different experience than she’d had with other brokers.

Waters took the time to ask questions about Divine Journeys, its mission, and what services it would offer — and which ones it wouldn’t.

“We spent an hour on the phone,” Elloway said. “They need to understand what you actually do and what service you actually provide.”

Unlike the previous brokers she had spoken with, Waters didn’t get scared away or end the conversation the instant he heard the word “ketamine.” Instead, he asked questions.

“In the case of the ketamine thing,” Waters explained, “I knew to ask, ‘Are you prescribing?’ ‘Are these services you’re providing directly?’ And the answer was ‘no.’”

When it became clear to Waters that Divine Journeys would only be connecting clients with outside organizations that offered psychedelic therapy, and not providing it themselves, he provided Elloway with an application for NIA coverage.

“He said, ‘fill out what you can on the application, send it back to me, and we’ll work on anything that was confusing together,’” Elloway said.

Waters and Elloway worked together to get the application completed and sent to NIA’s underwriters to review.

“Within a week, he [Waters] called and said, ‘All done, we’re good!’” Elloway said. “I literally cried on the phone — I thought I was never going to get this done.”

Fully insured at last, Divine Journeys was able to begin operations at the end of September.

“I’m super grateful and so excited,” Elloway said. “It was a real jackpot for me to find someone who listened.”

A Story That’s Far Too Common

According to Waters, Divine Journeys’ story is one he’s seen many times in his 20 years of working with nonprofit organizations.

“That story of having a nonprofit get beat up before they come to me?” he said. “That’s the rule, not the exception.”

The problem, Waters explained, is that most brokerages do not have brokers that specialize exclusively in nonprofit clients the way NFP does.

That leaves nonprofits with brokers who are accustomed to working with businesses, where standardized, one-size-fits-all coverage is the norm — one type of coverage for a gas station, another type for a restaurant, and so on.

But, with organizations coming in all shapes, sizes, and missions, a standardized approach doesn’t really work for nonprofits.

“If you’ve seen one gas station, you’ve seen them all — a standardized application will fit everyone just fine,” he said. “But, when you’ve seen one nonprofit, you’ve seen one nonprofit.”

When those brokers who aren’t used to working with nonprofits see how wildly different each one is, he explained, they don’t know what to do, and clients aren’t likely to be served well.

“Nonprofits just don’t fit into these nice little boxes,” Waters said. “Unless someone on the broker side has the experience to understand nonprofits, they’re going to send them to all kinds of strange places.”

The Benefit of Experience and Understanding

Waters explained that, when a broker does have experience working with nonprofits and has been given the opportunity to work exclusively with nonprofits, it allows them to anticipate what questions or issues an insurance provider might have about an individual nonprofit’s risks — and work with the nonprofit to address them ahead of time.

“It takes being able to truly understand what a nonprofit is doing, document it, and present it to underwriters in a way they can understand and work with it,” Waters said. “I ask enough questions to identify when something represents a risk, describe it, and then quantify it.”

Waters has been an affiliated broker of NIA for many years, experience which has given him an understanding of NIA’s underwriting process, its broad coverages, and its appetites — which risks they consider too risky, and which are insurable.

In the case of Divine Journeys, he explained, the nonprofit was talking about ketamine and psychedelic therapy, but they were not actually providing these services — which was the difference.

“I knew it was going to be asked about, so I documented it in such a way that it was answered as part of the submission,” he said.

Typically, Waters said, he works with about a dozen nonprofits every month looking for coverage — but for new nonprofits, he offered some tips.

“Find a brokerage to work with that specializes in nonprofits — not one that does nonprofits only as a side line,” he said. “That person should have the experience to understand what needs to be done, and what questions need to be asked to provide the underwriters with the information they need to accurately underwrite the risk.”

Did NIA help your nonprofit secure insurance when nobody else would?

Are you a broker that used your special nonprofit experience to get a particularly good outcome with NIA?

Please let us know, as we are creating more articles like this.