NEW YORK — On Friday, Sept. 15, New York Gov. Kathy Hochul signed legislation that will enable nonprofit risk retention groups (RRGs) domiciled outside of the state to write auto insurance policies to nonprofits across the state.

This signing was announced at 12 noon ET, by Assemblymember Anna Kelles and state Sen. Lea Webb, who worked closely to guide the bill (A.5718a / S.5959a) through the New York legislature.

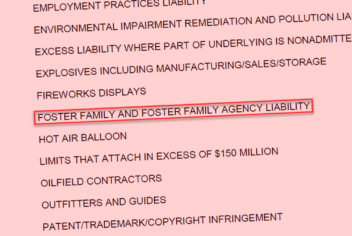

This signing represents a major victory for the entire nonprofit sector. Nonprofits are often unable to secure insurance from commercial insurance companies. These carriers are often unwilling to provide the specialized coverages nonprofits need. Risk retention groups (insurance companies owned by their members — similar to credit unions) have proven a viable alternative in these situations.

Once the new law begins to take effect in early 2024, risk retention groups can begin the process to start offering auto coverage for 501(c)(3) nonprofits across the state.

The drive to pass this bill came as a nonprofit carshare, Ithaca Carshare, found itself unable to find car insurance for its fleet of shared vehicles.

Because no insurer operating in New York was willing to provide them with the auto coverage they needed, Ithaca Carshare was forced to temporarily halt their operations — removing a popular alternative transportation option for the Ithaca community.

Other carshares, hoping to enact similar programs, have also seen their plans delayed by this lack of available coverage.

“By passing this legislation, we’re ensuring that Ithaca Carshare and similar not-for-profits can access the essential automobile insurance they need to remain open, flourish, and provide customers with critical access to transportation,” Hochul said.

Risk retention groups can provide an alternative for nonprofits to private and commercial insurance carriers, but New York law forbade RRGs that weren’t domiciled in the state to offer auto coverage — severely limiting nonprofits’ options when seeking coverage.

Alliance of Nonprofits for Insurance, RRG, part of Nonprofits Insurance Alliance (NIA), participated in the advocacy efforts for the bill’s passage. NIA CEO Pamela E. Davis said that the organization looks forward to New York nonprofits having viable options for auto insurance as the new law rolls out.

“We’ve insured carshares since the early 1990s and other nonprofits since the late 1980s,” said Davis. “We look forward to serving carshares and a variety of nonprofits in New York thanks to this law.”

About NIA

Nonprofits Insurance Alliance (NIA) is the nation’s leading liability and property insurer exclusively serving nonprofit organizations.

Founded in 1989 in Santa Cruz, CA, NIA is a social enterprise focused on the long-term sustainability and management of risk in the nonprofit sector. NIA has one of the best customer retention rates in the industry.

NIA members enjoy fair and equitable insurance pricing, specialized insurance coverages, dividends, and innovative risk management and member resources.

The NIA group brand is comprised of Alliance Member Services (AMS) and three insurers rated A- (Excellent) by AM Best: Nonprofits Insurance Alliance of California (NIAC); Alliance of Nonprofits for Insurance, RRG (ANI); and National Alliance of Nonprofits for Insurance (NANI).

All organizations under the NIA brand are 501(c)(3) nonprofits. Learn more about Nonprofits Insurance Alliance at insurancefornonprofits.org.