How Nonprofits Can Reduce Risk While Providing Support During a Natural Disaster

Guidelines for nonprofits during natural disasters. How to coordinate with those in charge of disaster response and join with relief efforts in other communities. How to get involved with the local community’s disaster planning. How to prepare nonprofit teams to serve in a way that is mindful of resources and mission.

Making Insurance Accessible Again with Chris Reed

In this episode of the AACS Today podcast, Chris Reed discusses legislation that would make property insurance more accessible to nonprofits.

Children’s Cancer Support: Insurance Explained

Pediatric cancer support nonprofits help patients and their families during the most difficult and heartbreaking experiences imaginable. What do they need most from their insurance?

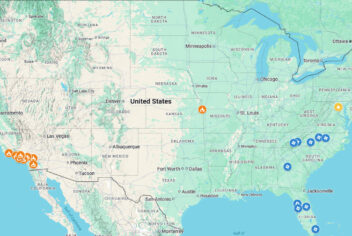

How NIA Members Helped During Recent Natural Disasters

When natural disasters strike, that’s when people of all backgrounds unite, put their differences aside, and work together for the benefit of their community — just like nonprofits do every single day.

Why Are Nonprofits Experiencing An Insurance Crisis? And What Can the Nonprofit Sector Do About it?

Rising premiums, poor coverage from commercial carriers, and even the loss of coverage make it hard for nonprofits to get the insurance they need. But it doesn’t have to be that way.

Blue Avocado Recap: February 2025

When does it mean to be a leader? Nonprofits' goals and priorities for 2025. A new way to show your donors how their money makes a difference.

Scholarship Foundations: Insurance Explained

Nonprofit scholarship foundations help provide access to education, new skills, and create lifelong lovers of learning. What’s most important to these nonprofits when it concerns their insurance? Here’s what some real NIA members had to say.

Friends of Libraries: Insurance Explained

“Friends of the Library” nonprofits help ensure that local libraries, and the services they provide, are available to their communities. What do they need most from their insurance?

Autism Organizations: Insurance Explained

Individuals, families, and caregivers depend on nonprofits that provide resources and support to the autism community. When it comes to insurance for these organizations, what’s most critically important? Here’s what NIA members had to say.

We Really Need to Talk About the Scams Targeting Nonprofits

Scams that specifically target nonprofits, and some things any nonprofit can do to reduce their chances of falling for them.

From the Claims Files: Phishing Scams

Your nonprofit's insurance likely does not cover situations where money is given away voluntarily. Tips to avoid phishing scams.

Court Appointed Special Advocates (CASAs): Insurance Explained

Nonprofits that provide Court Appointed Special Advocates (CASAs) are an essential source of support for children who have been the victims of abuse or neglect. When it comes to insurance needs, what matters most to these organizations? Here’s what some real NIA members had to say.