I am having one of those moments. I don’t know whether to pull out my hair or jump for joy.

On November 9, 2023, we received a survey from the Missouri Department of Commerce & Industry asking us if Alliance of Nonprofits for Insurance, RRG (ANI) provides standalone commercial property coverage and/or standalone commercial auto physical damage coverage for nonprofits.

Seems harmless enough. In a way, it’s fantastic that this issue is finally getting some attention from the Missouri Department of Commerce & Industry.

But, here’s the issue: Missouri’s Director of Insurance, Chlora Lindley-Myers, is also the President of the National Association of Insurance Commissioners (NAIC) — the very same trade association of state insurance regulators that has been actively blocking risk retention groups (like ANI) from being able to provide nonprofits the coverages described above that they so desperately need.

In January 2020, it was Ms. Lindley-Myers who sat next to me at a hearing before the House Financial Services Committee and assured members of Congress that my testimony that nonprofits could not get access to property insurance was much ado about nothing — claiming that “state insurance departments have received few, if any, complaints from nonprofit policyholders indicating that they are unable to obtain the coverage they require.”

At that same hearing, I also had to remind Ms. Lindley-Myers that hundreds of nonprofits in Missouri already relied on ANI for their liability insurance — and that the only reason those nonprofits had any source of standalone commercial property coverage and/or standalone commercial auto physical damage coverage available in the form they need was because ANI had arranged it through a fronting company program.

In my remarks in 2020, I was clear that the fronting company had changed their strategy and was intending to move on to other programs as soon as we could find replacement coverage.

I also testified that we had exhaustively reviewed insurance company filings across the country trying to find other insurance companies that would offer these coverages to small and mid-sized nonprofits. We came up empty-handed.

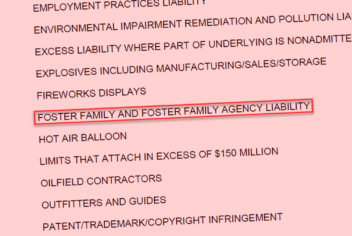

My ask of Congress was to allow RRGs for nonprofits, like ANI, to write property and auto physical damage insurance, in addition to the liability insurance policies we have been writing successfully for three decades.

Dozens of nonprofit associations have begged insurance commissioners to step out of the way of the Nonprofit Property Protection Act (NPPA), which would bring great relief to nonprofits.

Insurance brokers have written op-eds about this problem; insurance industry magazines have featured many stories about the nonprofits struggling to find insurance they need; and surveys and studies have been widely circulated documenting this problem.

But for nearly a decade, the NAIC has claimed that lack of property insurance is not a problem for nonprofits and that, even if it is, the surplus lines market is good enough for nonprofits.

How dare they?

What makes this latest survey particularly rich? Under present law, RRGs like ANI are entirely prohibited from writing property insurance. You’d think the Missouri Department of Commerce & Industry should know this — they are an insurance regulator after all.

And yet, they sent ANI a survey asking us if we provide the very coverage their own trade association — which their Director of Insurance serves as president — has been working overtime to prevent us from offering!

Moreover, the NAIC crows about their extensive and sophisticated SERFF database, to which all insurance departments have access. Yet it seems their regulators need to send a survey to insurance companies to figure out if anyone is providing this insurance in a state. That is some crack database!

The survey certainly seems to be evidence that they don’t have a clue if this insurance is available to nonprofits, and never have.

So much for insurance regulators having the pulse on what is happening in their states!

To be fair, we know that a couple states have recognized the problem (New Hampshire, Louisiana) and, as I wrote about in a prior article, Pennsylvania’s commissioner questioned the availability of this coverage at the NAIC’s spring 2023 meeting — and the opponent even admitted he could not produce a list of carriers offering it.

But the NAIC remains opposed to any federal solution because of their turf-protecting principle to oppose any federal involvement in insurance.

Even the survey itself is flawed. A survey about Missouri nonprofits’ insurance access is not a good measure of what is happening across the country. There are no questions about what forms insurance companies use to provide this coverage nor what minimum premiums apply.

Apparently, this is their effort to conduct the “study and report on the availability and affordability of liability and property coverage for non-profit organizations” that the NAIC touted in a letter to Congress in 2022.

They sent that letter to tank a discussion draft that Sen. Sherrod Brown, Chair of the Senate Banking Committee, had circulated to allow nonprofits to solve this problem for themselves.

Earlier bills to solve this problem have been introduced in the House of Representatives — by members of both parties — only to face similar tactics by the NAIC.

It’s one of the oldest tricks in the book: When you know you have been blowing smoke for a decade and your misinformation campaign is about to be exposed, do a study!

Again, while we are grateful that the president of NAIC is at least making an effort to finally figure out what is happening in her state, it is too little, too late. It’s time to let nonprofits fix this problem themselves through the Nonprofit Property Protection Act (NPPA).

I don’t know about you, but this entire scenario makes me very concerned about the integrity of state-based insurance regulation in this country and whether it will be able to meet the challenges ahead.