No matter your politics or beliefs, every child deserves safety and stability. Yet in California, the foster care system is being pushed to the brink, and kids are paying the price.

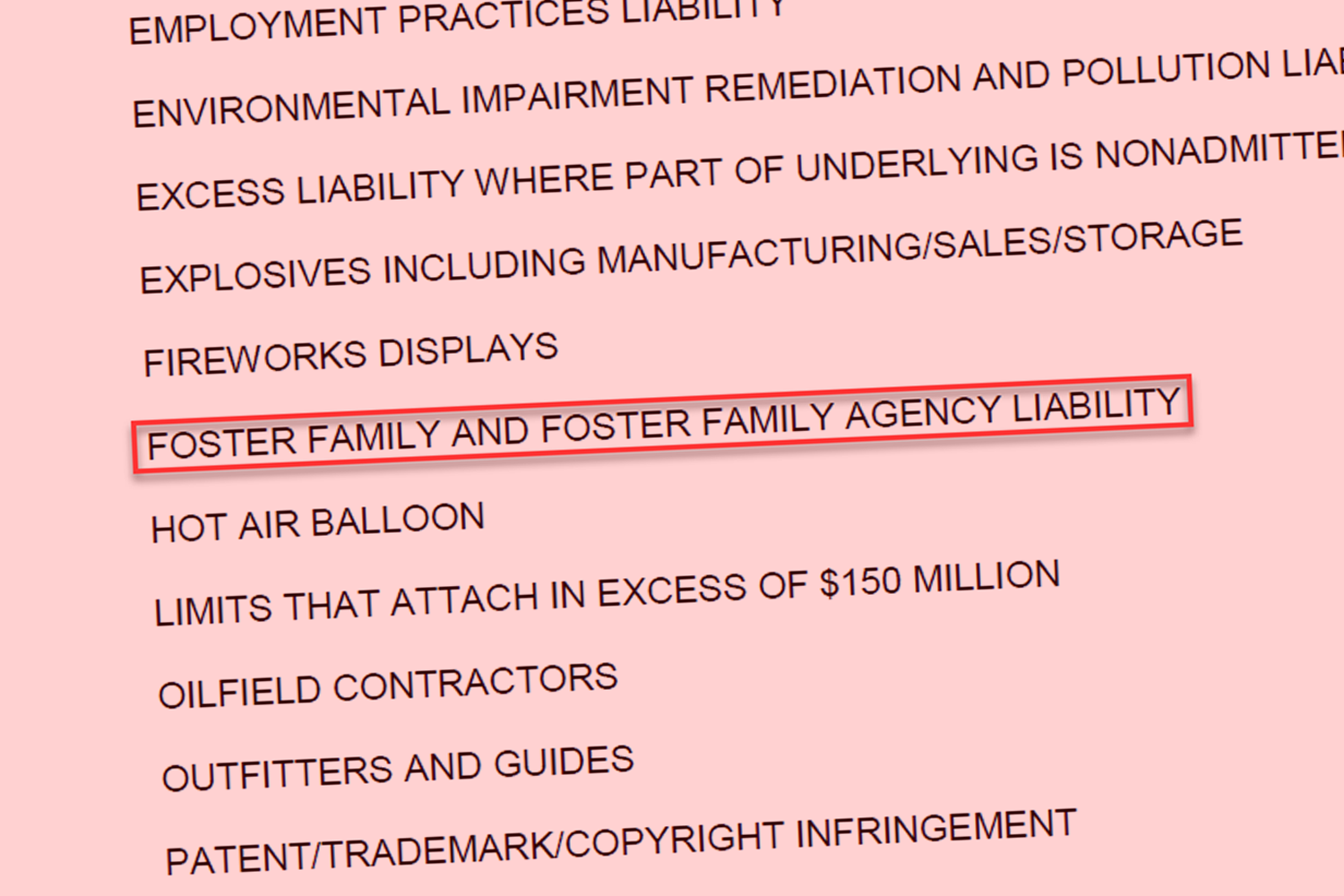

It’s a sad state of affairs when foster family agencies rank on the same risk scale as fireworks displays and hot air balloons. On November 24, 2025, California Insurance Commissioner Ricardo Lara placed Foster Family and Foster Family Agency (FFA) Liability coverage on the state’s “Export List.” This means coverage can now be placed with surplus lines insurers without first searching the admitted market.

In plain terms, traditional insurers have walked away from FFAs, because loopholes in California’s judicial system have made FFAs impossible to insure.

Why does this matter? When coverage moves to the surplus lines market, premiums are higher and policies are less useful. FFAs, already operating on thin budgets, now face skyrocketing costs. That means fewer foster families, fewer placements, and fewer children served. It also means more children growing up in institutions and group homes.

This crisis didn’t happen overnight. For years, advocates like Nonprofits Insurance Alliance (NIA) warned that, without meaningful reform, there would be no viable market for this coverage. A bill that could have restored balance was blocked in 2024 by plaintiff attorneys.

Plaintiff attorneys are making a fortune exploiting FFAs using loopholes in California law, which allows FFAs to be held liable for harms they could not have predicted or known about. In cases where the FFA had no knowledge of risk, or the ability to know of any danger posed to the children they oversee, FFAs still bear full liability when harm does come to a child. This is true even in cases where there was nothing the FFA could have done to prevent the injury.

The result: FFAs now spend more money on litigation and insurance and less money on the care of foster children.

In contrast, Texas lawmakers acted swiftly and with overwhelming support to solve the same problem. In 2025, the Texas Legislature passed a reform bill that limits liability for nonprofit foster family agencies that follow required due diligence such as background checks, abuse-prevention training, misconduct reporting, and had no knowledge of specific risk to a child. At the same time, it holds agencies accountable for negligence.

This reform has already begun unlocking the insurance market for foster agencies in Texas. It reduces pressure on providers, lowers premiums, and prevents foster children from being raised in group homes. As a result, more children remain in safe homes without disruption, and agencies can focus on taking care of children instead of legal battles and paying for the criminal acts of others.

Every time a foster family agency closes or limits services, children lose safe homes. Every delay in reform means more kids waiting in uncertainty. Without action, the cycle of risk and scarcity will deepen. The ones who suffer most are the children who need help the most.

California’s foster care system deserves better. Kids deserve better. It’s time to fix this.