Santa Cruz, Oct. 02, 2019 — (GLOBE NEWSWIRE) — Nonprofits Insurance Alliance (NIA), the leader in insurance and risk management for the 501(c)(3) nonprofits sector, today announced its support for H.R. 4523, the Nonprofit Property Protection Act (NPPA). Sponsored by Congressman Al Green of Texas, with 6 original cosponsors, the legislation was introduced in the 116th Congress after public hearings on the challenges small nonprofit organizations–the vast majority of nonprofits–face in finding affordable insurance that meets their specialized needs. The bill fixes a specific market gap that impacts nonprofits across the nation.

Commercial for-profit insurers serve niche segments of the nonprofit market, but many small nonprofits do not have access to the customized solutions they need. Ninety-two percent of 501(c)(3) nonprofits have annual budgets of less than $1 million, and 88% spend less than $500,000 annually for their work, according to the National Council of Nonprofits.

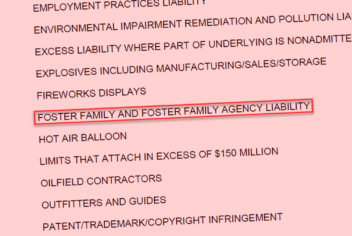

The stand-alone property half of a businessowners policy and auto physical damage policies some nonprofits need are not available from commercial insurance companies. A small subset of commercial carriers is willing to insure nonprofits as part of a bundled package including general liability, sexual abuse, professional, and property all combined but there is only one commercial carrier in the country offering the type of property coverage smaller nonprofits members need on a stand-alone basis, and it is not economically efficient for them to continue to provide it.

“The insurance industry has failed to innovate and meet the needs of nonprofit policyholders,” said Pamela E. Davis, founder and CEO of Nonprofits Insurance Alliance (NIA). “Imagine the uproar if large companies were offered a take it or leave it insurance policy, yet that’s what many small nonprofits are offered today.”

Original bill cosponsors include Rep. Al Lawson (FL), Rep. Gregory Meeks (NY), Rep. Jesus “Chuy” Garcia (IL), Rep. Jimmy Panetta (CA), Rep. Sheila Jackson Lee (TX), and Rep. Lacy Clay (MO).

The legislation has support from over 1,000 organization across the country including from these leaders of nonprofits:

- “We strongly urge you to support nonprofits by helping the Nonprofit Property Protection Act become law. Nonprofits need options to meet their insurance needs so that we may operate as effectively and efficiently as possible – consistent with our charitable purposes – in service to our communities.” — Michael J. Shaver, Chair, Public Policy and Advocacy Committee, Children’s Home Society of America

- “Finding affordable property/casualty insurance is routinely difficult for child-serving organization because of the nature of our operations. Commercial insurance companies vary in their appetite for these risks based on the litigation climate and reports in the press of high profile lawsuits. Consequently, it is critically important that there are as many as possible insurance options available to these organizations to assure they have adequate coverage at affordable rates. At no cost to government, Risk Retention Groups (RRGs) for nonprofits provide viable alternatives that are accountable to the nonprofit sector and that operate for nonprofits’ exclusive benefit.” — Ilana Levinson, Senior Director, Government Relations, The Alliance for Strong Families and Communities

- [W]ith limited insurance options, land trusts are denied the risk management solutions that would enable them to make the best use of their funds in service to their missions. We urge you to help this [legislation] become law so that small and mid-sized organizations, like land trusts, may operate as safely and effectively in the public interest as possible.” — Wendy Jackson, Executive Vice President, Land Trust Alliance

- “RRGs allow nonprofits to pool their resources to get the best possible insurance coverage and risk management that is tailored specifically for their needs. Nonprofits endeavor to use their resources wisely and to invest a much as possible of our limited budget into our missions in service to the public. Limited insurance options or coverage that is inappropriate limits a nonprofit’s ability to make the best use of funds in service to mission. Nonprofits are able to correct this problem with the passage of the Nonprofit Property Protection Act.” — Lee I. Sherman, President & CEO, National Human Services Assembly

- “California Alliance members work hard to efficiently manage operating expenses, of which insurance can be one of the most significant. The Nonprofit Property Protection Act would enable our members to more efficiently and effectively cover their insurance risks, would allow nonprofits’ own insurance company to collect better data on risk for nonprofits which would in turn allow them to better assist our members reduce accidents and injuries, and together would increase our members’ ability to serve California’s communities.” — Christine Stoner-Mertz, Chief Executive Officer, California Alliance of Child and Family Services

- “This critically important bill will allow certain Risk Retention Groups serving501(c)(3) nonprofits to provide property insurance and auto physical damageinsurance as well as the liability insurance they already provide. Access to theright insurance products, including the option to insure the property of ourmembers within their own insurance company, is important to our colleges anduniversities to allow them to serve students and our communities as efficiently aspossible. With all the challenges facing our colleges and universities, findingappropriate and affordable liability and property insurance should not be one of them.” — Mary Ellen Moriarty, Vice President for Property & Casualty, CollegeRRG

NIA is marking its 30th anniversary in 2019. Founded during an insurance market crisis, NIA has demonstrated the ongoing need for the nonprofit sector to have its own insurance company focused on the exclusive risks and needs of 501(c)(3) organizations.

About Nonprofits Insurance Alliance

Nonprofits Insurance Alliance (NIA) is a cooperative of 501(c)(3) tax-exempt nonprofit insurers whose sole purpose is to serve 501(c)(3) tax-exempt nonprofits. NIA provides a stable source of reasonably-priced liability insurance tailored to the unique needs and conscientious budgets of nonprofits. NIA also provides risk management resources exclusively to 501(c)(3) nonprofits to help prevent insurance claims that disrupt nonprofits’ services to vulnerable communities. The NIA group is comprised of Nonprofits Insurance Alliance of California (NIAC), Alliance of Nonprofits for Insurance, RRG (ANI), National Alliance of Nonprofits for Insurance (NANI) and Alliance Member Services (AMS).