Category: Insurance Issues for Nonprofits

Nonprofit Homeless Shelters Targeted by Get-Rich-Quick Scheme

Nonprofits providing cities with affordable housing for the homeless have been hit by a get-rich-quick scheme from opportunistic plaintiff attorneys. Cash in, rinse, repeat.

Being Baited By Lower Cost Insurance?

Transparency about why insurance costs are so high right now, and why NIA had to increase rates too.

Factors Driving Up Increases in Auto Liability Premiums in 2025

Why increases in auto liability and physical damage premiums will be coming in 2025.

High Umbrella Limits Are A Big Liability

High limits of umbrella put a rich target on nonprofits and invite plaintiff attorneys to go hunting for disgruntled clients.

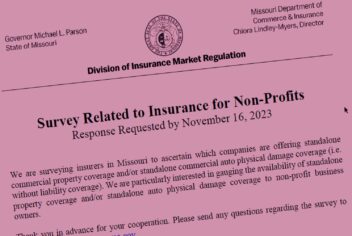

The Missouri Department of Commerce & Industry sent a survey to see if insurers are offering coverages nonprofits need. Too little, too late.

How to Choose the Right Insurance Broker for Your Nonprofit

Your nonprofit’s insurance broker should have your back. How to make sure you’ve got the right person in your corner.

Insurance Trade Association Using Clout to Hurt Nonprofits

Determined to maintain control over a market they don’t even want, NAMIC is working with regulators to kneecap nonprofits.

Common Insurance Mistakes Made by Nonprofits

Insurance experts and brokers share how your nonprofit can avoid common mistakes nonprofits make when it comes to insurance so you can focus on doing what you do best — serving your community.

Managing Your Nonprofit’s Coverage Policies

You have insurance to minimize your nonprofit's risk. As your nonprofit changes, don't forget to regularly review and update your policies.

When a Website is Discriminatory for Not Being Accessible

Inaccessible websites are increasingly being targeted as violations of disability accommodation laws. Is your nonprofit's website at risk?

Boys & Girls Clubs: Insurance Explained

Boys & Girls Clubs want insurance that fits, from an insurer that wants to work with them, understands them, and enhances their mission.

Occurrence-based vs. Claims-made Policy: What’s the Difference to Your Nonprofit?

Commercial General Liability (CGL) insurance coverage falls into two policy categories: occurrence-based and claims-made. What do these terms mean to your nonprofit? Which is best for your nonprofit? For nonprofits, occurrence-based policies are almost always a better option, because they give you more protection and fixed-costs.